Gold Climbs to Record Above $5,500 on Bets for Dovish Fed Chair

Gold Climbs to Record Above $5,500 on Bets for Dovish Fed Chair

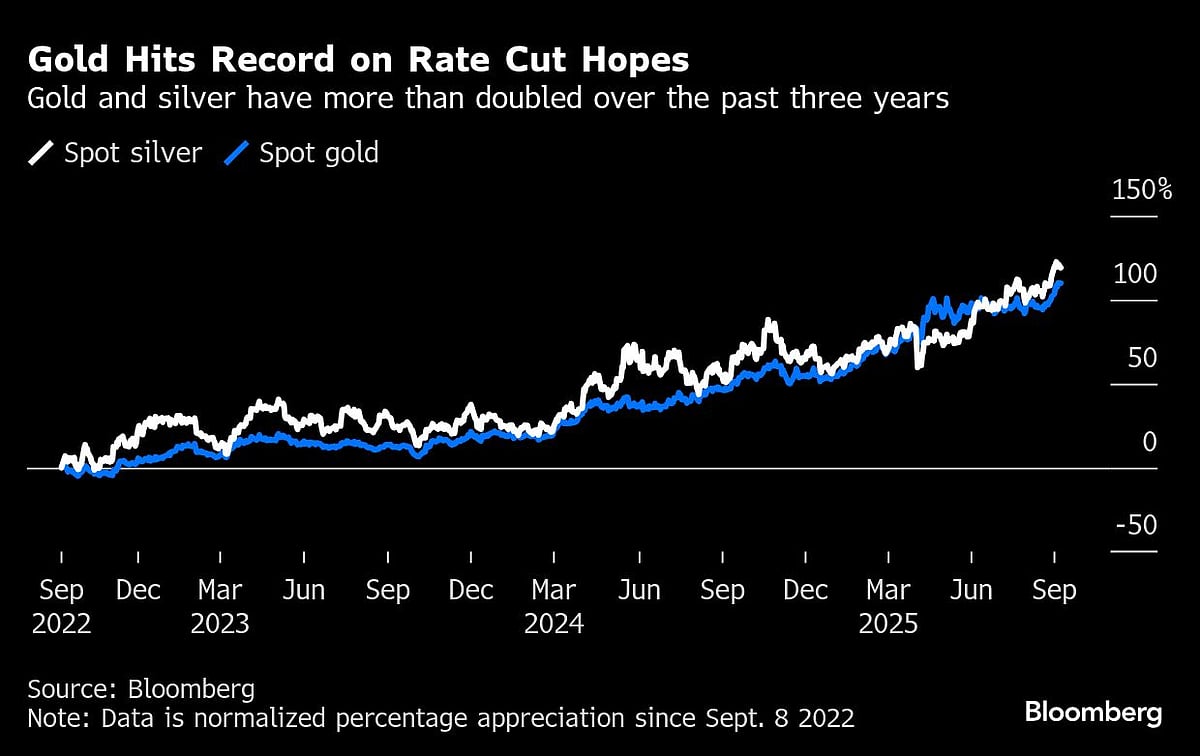

The price of gold (XAU/USD) shattered yet another psychological barrier this week, surging past the unprecedented $5,500 per ounce mark. This historic rally is not merely a statistical anomaly; it is a direct reflection of a tectonic shift in market expectations regarding U.S. monetary policy. The consensus across trading floors suggests that the Federal Reserve is poised to usher in an easing cycle sooner and more aggressively than previously forecasted.

For context, just six months ago, $5,000 seemed like an ambitious ceiling. I remember speaking with a veteran floor trader, Mark, who has seen cycles dating back to the Volcker era. He told me last Tuesday, "I've never seen such rapid, sustained institutional buying pressure without a major geopolitical Black Swan event. This isn't panic buying; this is strategic realignment based entirely on interest rate expectations." Mark's observation underscores the specific nature of this gold boom—it's a bet on the dollar's inevitable softening.

The yellow metal, long cherished as the ultimate safe-haven asset, now finds itself benefiting from the potential erosion of real yields. As inflation remains sticky, and key figures within the central bank signal a pivot toward rate cuts to support broader economic growth, non-yielding assets like bullion suddenly become far more appealing compared to fixed-income instruments like Treasury bonds.

The Driving Force: A Pivotal Shift in Central Bank Sentiment

The primary catalyst for gold's recent monumental jump lies squarely in the perceived shift within the Federal Reserve leadership. Investors are increasingly betting on the appointment or emergence of a more "dovish" Fed Chair—someone prioritizing labor market health and inflation management over maintaining aggressively high interest rates for an extended period. This change in tone has fundamentally altered the calculus for bond traders and gold investors alike.

The market had been priced for perhaps two rate cuts over the next year. Now, major banking institutions are revising forecasts to three or even four cuts, with the potential for the first move coming as early as the next quarter. This aggressive repricing is what feeds the gold rally.

When the Federal Reserve cuts the federal funds rate, the opportunity cost of holding gold decreases dramatically. Since gold doesn't pay interest or dividends, its attractiveness rises relative to interest-bearing assets. This simple economic relationship has historically fueled gold booms during periods of monetary easing.

Specific indicators feeding the current dovish narrative include:

- Slowing Job Growth: Recent non-farm payroll reports have shown softness, suggesting the economy is beginning to feel the pain of past rate hikes.

- Weakening Manufacturing Data: Key PMI surveys indicate contraction, bolstering the argument for necessary economic support from the Fed.

- Subdued Inflation Expectations: While current CPI remains above target, longer-term inflation expectations are stabilizing, providing the Fed the necessary political cover to ease policy.

- Verbal Intervention: Several non-voting Fed members have publicly advocated for a pre-emptive easing to avoid a recession, signaling growing internal division in favor of lower rates.

This dynamic ensures that $5,500 is not just a high-water mark, but potentially a new floor. Large institutional funds are positioning themselves to capitalize on lower U.S. Treasury yields, dumping paper assets in favor of physical gold and gold-backed ETFs.

Analyzing the $5,500 Threshold: Technical and Psychological Barriers

Breaking above $5,500 carries immense technical and psychological weight. In trading analysis, round numbers often serve as strong psychological resistance points. The decisive breach suggests that the underlying momentum is extraordinarily strong, validated by high trading volumes globally.

Technically, the rally has been healthy. It hasn't been characterized by one massive spike followed by consolidation, but rather a stair-step pattern, indicating steady accumulation. For many long-term investors, gold is not just an inflation hedge; it is currency insurance. The acceptance of the $5,500 price point suggests a deepening distrust in the long-term purchasing power of fiat currencies.

Furthermore, global geopolitical instability continues to provide essential background support for the price of gold. While the Fed pivot is the primary driver, ongoing tensions in Eastern Europe and the Middle East ensure that a risk premium remains baked into the price. Gold serves as the universally recognized hedge against systemic chaos.

- Increased Central Bank Buying: Several major global central banks, particularly those in emerging markets, have been aggressive buyers of physical gold over the last two years, diversifying away from U.S. dollar reserves. This structural demand provides a robust baseline for prices.

- Demand from Asian Markets: Consumer demand in key markets like China and India remains high, especially during festival seasons, further soaking up supply.

- Erosion of Real Yields: As nominal rates drop while inflation persists, real returns on fixed income turn negative, amplifying the appeal of zero-yield gold.

- Dollar Weakness: The expected shift towards a dovish stance naturally puts downward pressure on the U.S. Dollar Index (DXY). Since gold is priced in dollars, a weaker dollar makes bullion cheaper for international buyers, increasing overall demand and price appreciation.

The current market environment offers a perfect storm: strategic institutional buying fueled by central bank policy expectations, combined with resilient physical demand and persistent geopolitical risk premiums. This confluence of factors validates the $5,500 level not as an overshoot, but as the market's new reality.

What's Next? Outlook for Bullion and Market Volatility

While the momentum is overwhelmingly bullish, a Senior SEO Content Writer must always maintain objectivity and look at potential headwinds. The path above $5,500 is likely to encounter heightened volatility. Key resistance levels now sit around $5,650 and then $5,800. Breaching these levels would likely require definitive confirmation of the Fed's dovish pivot.

The biggest risk to the continuation of the gold rally would be a sudden re-acceleration of U.S. economic data—specifically, if inflation spikes unexpectedly or if the job market shows surprising resilience. Such an event would force the Federal Reserve to reverse course, adopting a more 'hawkish' tone and delaying or reducing planned interest rate cuts. A hawkish surprise would send Treasury yields soaring and gold prices plummeting.

However, analysts specializing in precious metals remain largely optimistic, viewing any short-term pullback as a buying opportunity rather than a trend reversal. The fundamental narrative—that the long cycle of aggressive interest rate hikes is over—remains intact.

Expert consensus suggests several key dynamics to watch in the coming months:

- The Dollar Index (DXY): Monitor the DXY closely. If it breaks decisively below key support levels, gold has clear runway to test $6,000.

- Fed Communication: Pay attention to minutes from FOMC meetings and speeches by core Fed governors. Any language softening the commitment to rate cuts could trigger a correction.

- Mining Stock Performance: Gold miners often serve as a leveraged bet on gold prices. Strong performance in these stocks indicates that the institutional money believes this rally is sustainable.

- Inflation Protection Demand: The ongoing debate over the Federal Reserve's ability to achieve a "soft landing" keeps the demand for gold as insurance against market chaos strong.

The record price above $5,500 signals that the market has fully discounted the probability of an aggressively dovish Federal Reserve. Investors are positioning for a new era where lower interest rates and elevated inflation risk become the norm. The precious metal is proving its resilience not just as a crisis hedge, but as a proactive investment vehicle against anticipated monetary policy shifts.

The golden era of high prices is here, underpinned by conviction that the path of least resistance for global central banks is downwards, cementing gold's position as a premium asset in a world of declining real yields.

Gold Climbs to Record Above $5,500 on Bets for Dovish Fed Chair

Gold Climbs to Record Above $5,500 on Bets for Dovish Fed Chair Wallpapers

Collection of gold climbs to record above $5,500 on bets for dovish fed chair wallpapers for your desktop and mobile devices.

Detailed Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Wallpaper in 4K

Transform your screen with this vivid gold climbs to record above $5,500 on bets for dovish fed chair artwork, a true masterpiece of digital design.

Artistic Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Background Illustration

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Lush Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Image Collection

A captivating gold climbs to record above $5,500 on bets for dovish fed chair scene that brings tranquility and beauty to any device.

Beautiful Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Design for Desktop

Experience the crisp clarity of this stunning gold climbs to record above $5,500 on bets for dovish fed chair image, available in high resolution for all your screens.

Lush Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Landscape Collection

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Lush Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Image in 4K

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Detailed Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Image in 4K

Transform your screen with this vivid gold climbs to record above $5,500 on bets for dovish fed chair artwork, a true masterpiece of digital design.

Breathtaking Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Landscape Digital Art

Explore this high-quality gold climbs to record above $5,500 on bets for dovish fed chair image, perfect for enhancing your desktop or mobile wallpaper.

Lush Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Landscape Illustration

A captivating gold climbs to record above $5,500 on bets for dovish fed chair scene that brings tranquility and beauty to any device.

High-Quality Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Picture Digital Art

Discover an amazing gold climbs to record above $5,500 on bets for dovish fed chair background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Exquisite Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Design Photography

A captivating gold climbs to record above $5,500 on bets for dovish fed chair scene that brings tranquility and beauty to any device.

Vivid Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Design Illustration

Transform your screen with this vivid gold climbs to record above $5,500 on bets for dovish fed chair artwork, a true masterpiece of digital design.

Stunning Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Capture for Mobile

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Beautiful Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Picture Concept

Explore this high-quality gold climbs to record above $5,500 on bets for dovish fed chair image, perfect for enhancing your desktop or mobile wallpaper.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XM7KMOFT75K2DLLYFDK2FVGOY4.jpg)

Exquisite Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Moment for Your Screen

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Mesmerizing Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair View for Mobile

Explore this high-quality gold climbs to record above $5,500 on bets for dovish fed chair image, perfect for enhancing your desktop or mobile wallpaper.

Dynamic Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Artwork in 4K

This gorgeous gold climbs to record above $5,500 on bets for dovish fed chair photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Gorgeous Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Design Nature

Find inspiration with this unique gold climbs to record above $5,500 on bets for dovish fed chair illustration, crafted to provide a fresh look for your background.

Gorgeous Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Picture in 4K

Immerse yourself in the stunning details of this beautiful gold climbs to record above $5,500 on bets for dovish fed chair wallpaper, designed for a captivating visual experience.

Lush Gold Climbs To Record Above $5,500 On Bets For Dovish Fed Chair Capture in 4K

A captivating gold climbs to record above $5,500 on bets for dovish fed chair scene that brings tranquility and beauty to any device.

Download these gold climbs to record above $5,500 on bets for dovish fed chair wallpapers for free and use them on your desktop or mobile devices.