Singapore dollar hits highest in over 11 years versus greenback

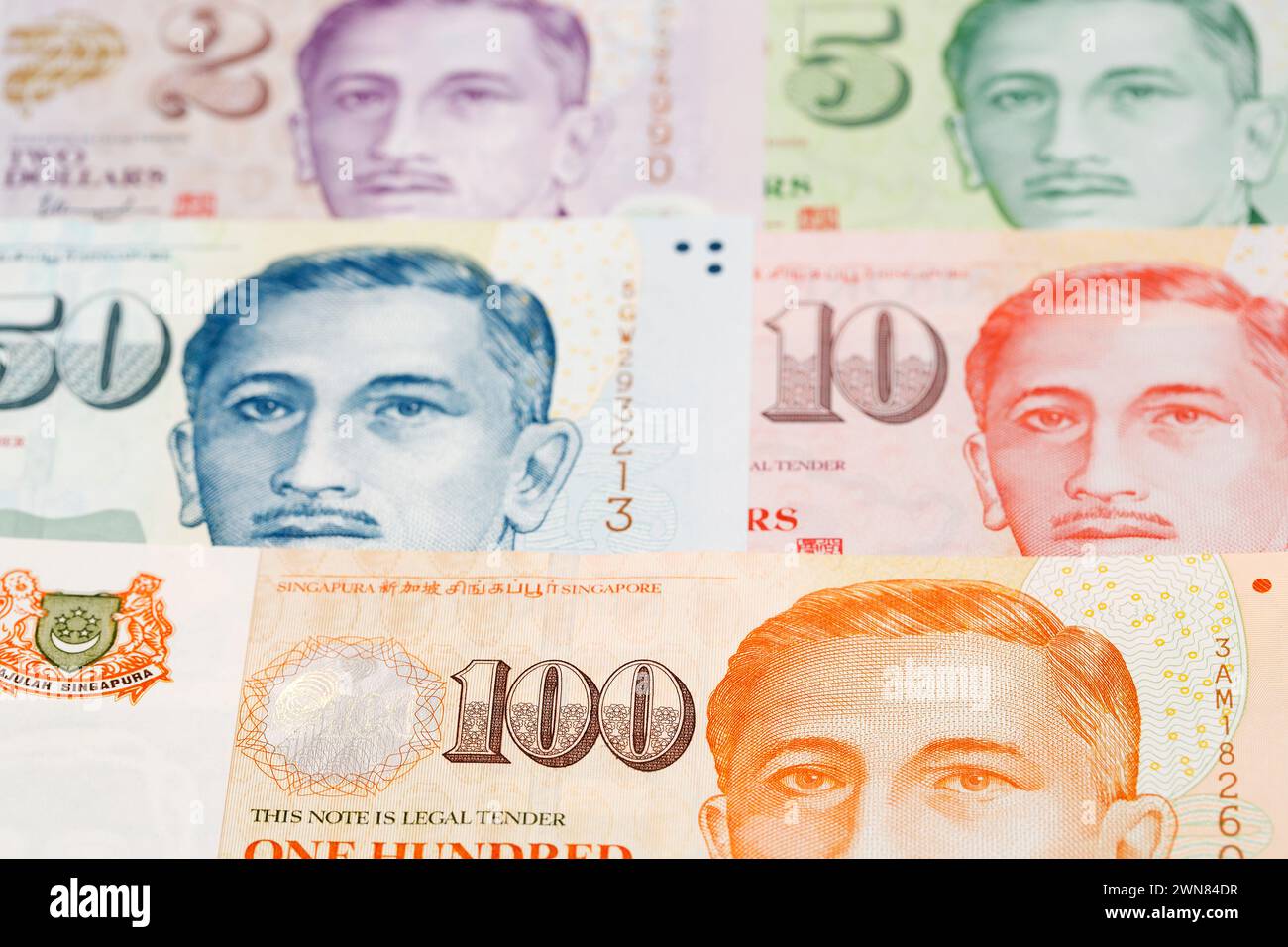

Singapore dollar hits highest in over 11 years versus greenback as MAS policy pays dividends

The Singapore dollar (SGD) has shattered expectations, soaring to its highest level against the US dollar (USD) in over 11 years. This significant movement confirms the city-state's currency as a beacon of stability and relative strength amidst global economic uncertainty. Breaking past key psychological barriers, the SGD's robust performance reflects a growing divergence in monetary policy and confidence in Singapore's proactive stance against inflationary pressures.

For anyone who has recently had to convert US dollars to pay tuition fees or settle business invoices in Singapore, the shift is palpable. I spoke to a US-based tech founder yesterday who lamented the sudden drop in his regional operating budget when converted to the local currency. "It felt like an instant 3% tax," he joked, though the concern was genuine. This anecdote perfectly illustrates the immediate power shift now underway in the USD/SGD pairing.

The Surge Explained: Decoding the Strength of the Singapore Dollar

The recent peak marks a crucial milestone. While the USD was once the unquestioned global reserve strength, the relative appeal of the greenback has waned, particularly against currencies managed by conservative, proactive central banks like the Monetary Authority of Singapore (MAS). The SGD's ascent is not a flash in the pan; it is the culmination of strategic policy decisions designed to combat external headwinds.

Unlike most central banks that manage interest rates, the MAS employs its exchange rate as its primary monetary tool. It manages the Singapore dollar against a trade-weighted basket of currencies (S$NEER). By adjusting the slope, width, and center of this band, the MAS effectively controls the cost of imported goods, directly battling inflation.

This aggressive, pre-emptive tightening stance has made the Singapore dollar an extremely attractive asset for global investors seeking safety and inflation defense. The movement pushes the SGD into territory not seen since the financial recovery period of the early 2010s.

The key factors fueling this immediate surge include:

- Risk-Off Sentiment: Global geopolitical risks and continued softness in key economies drive capital towards perceived safe-haven currencies. The SGD benefits immensely from this flight to quality.

- Aggressive Policy Settings: The MAS has maintained a tightening trajectory for several consecutive policy meetings, signaling zero tolerance for persistent, high inflation.

- US Debt and Fiscal Concerns: Ongoing political deadlock and ballooning US debt levels erode investor confidence in the long-term stability of the US dollar.

- Strong Economic Fundamentals: Despite global slowdowns, Singapore's economy has shown resilience, backed by robust financial services and strong trade ties.

Analysts suggest that as long as the MAS signals its preparedness to allow for further appreciation to fight imported inflation, the momentum favoring the SGD against the US dollar will continue to hold.

Monetary Policy Divergence: MAS Tightening vs. US Fed Uncertainty

The primary driver behind the 11-year high is the stark divergence in approach between the MAS and the US Federal Reserve. While the Fed has signaled possible pivots or pauses in its tightening cycle, primarily focusing on domestic labor markets and core PCE, the MAS has kept its foot firmly on the brake, targeting the exchange rate to suppress inflation.

Singapore, as a heavily trade-reliant economy, imports almost all of its food and energy. A stronger currency is therefore the most direct and effective weapon against rising consumer prices. The commitment shown by the MAS contrasts sharply with the mixed signals emanating from the US Federal Reserve.

The MAS Stance: Focus on the NEER

The MAS operates on the principle that allowing the SGD to appreciate within its band reduces the cost of imports, directly lowering headline inflation. This strategy has proven highly effective in stabilizing domestic costs, creating an environment of higher real returns for foreign capital.

Specific actions that have reinforced the SGD strength:

- Repeated upward re-centering and steepening of the S$NEER slope, essentially allowing faster appreciation.

- Clear forward guidance emphasizing the priority of price stability over immediate economic growth concerns, differing from many counterparts.

- The perception that Singapore has successfully navigated post-pandemic supply chain shocks better than many larger economies.

The US Fed's Dilemma: Growth vs. Inflation

The US dollar's recent weakness stems from market concerns that the US Federal Reserve may be nearing the end of its aggressive rate-hike cycle sooner than previously anticipated. Furthermore, the persistent threat of recession in the US has led to bets that the Fed might need to ease monetary conditions in the medium term.

This uncertainty, combined with softening US economic data, removes a key pillar of support for the greenback—namely, the guaranteed higher interest rate differentials that attracted capital previously. When the differential narrows, investors look elsewhere, and the robust policy settings of the MAS make the SGD a top candidate.

The impact of this policy gap is magnified by rising interest rate differentials in global debt markets, making SGD-denominated assets increasingly attractive compared to their lower-yielding, riskier USD counterparts.

Economic Consequences and the Safe-Haven Status of the SGD

For Singapore's trade and finance sectors, this historic rise presents a double-edged sword. While it solidifies Singapore's reputation as a safe-haven currency and improves consumer purchasing power, it simultaneously puts pressure on the nation's crucial export sector.

The Benefits of a Strong SGD

A high exchange rate delivers immediate advantages to consumers and businesses that deal primarily with imports:

- Lower Imported Inflation: The strongest benefit. Consumers feel less sting at the petrol pump and grocery store as the cost of global commodities drops when priced in SGD.

- Increased Purchasing Power: Singaporeans traveling or studying abroad find their money stretches further.

- Capital Attraction: A strong, stable currency attracts foreign direct investment (FDI) seeking an economic hub protected from extreme currency volatility.

The Challenges for Exporters

However, an overly strong Singapore dollar can quickly dampen the competitiveness of Singaporean goods and services on the international stage. Exporters, manufacturers, and tourism operators face significant headwinds:

- Export Competitiveness: Singaporean products become more expensive for international buyers holding USD or other weaker currencies.

- Tourism Costs: While travelers value stability, a high exchange rate makes Singapore a relatively more expensive destination for tourists, potentially affecting visitor numbers.

- Profit Margins: Companies earning revenue in foreign currencies (like USD) but reporting expenses in SGD see their profit margins squeezed during conversion.

The MAS must delicately balance this appreciation. While fighting inflation is paramount, excessive strength could risk jeopardizing the broader export-oriented economy.

Global Headwinds: Trade Tensions and the Greenback's Challenges

Beyond the local dynamics, the US dollar's sustained weakness against the Singapore dollar is part of a broader global trend reflecting increased risk-off sentiment and a reshuffling of global supply chains. The ongoing complexities surrounding trade tensions—particularly between the US and China—continue to benefit neutral, established trading hubs like Singapore.

When global economic activity slows, or geopolitical risks escalate, capital tends to move into jurisdictions perceived as politically stable and fiscally sound. Singapore fits this description perfectly, reinforcing the SGD's status as a premier safe-haven currency in Asia.

The continued debate over deglobalization and the fragmentation of trade routes ensures that currency stability remains a premium asset. The Singapore dollar's ability to outperform the greenback over an 11-year horizon speaks volumes about the market's long-term assessment of fiscal prudence and effective monetary management in the Lion City.

Looking ahead, while some consolidation is expected, the structural drivers supporting the SGD remain largely intact. Unless the US Federal Reserve unexpectedly signals a return to aggressive tightening or the MAS drastically alters its inflation focus, the Singapore dollar is likely to maintain its elevated position, challenging the traditional dominance of the greenback in the region.

Singapore dollar hits highest in over 11 years versus greenback

Singapore dollar hits highest in over 11 years versus greenback Wallpapers

Collection of singapore dollar hits highest in over 11 years versus greenback wallpapers for your desktop and mobile devices.

Detailed Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene Concept

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Crisp Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Moment in 4K

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Stunning Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Background Collection

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Stunning Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Wallpaper Concept

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Dynamic Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture for Desktop

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Spectacular Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Capture Photography

Find inspiration with this unique singapore dollar hits highest in over 11 years versus greenback illustration, crafted to provide a fresh look for your background.

Mesmerizing Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Design Collection

Discover an amazing singapore dollar hits highest in over 11 years versus greenback background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Abstract Photography

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Moment for Your Screen

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Exquisite Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Image in 4K

Immerse yourself in the stunning details of this beautiful singapore dollar hits highest in over 11 years versus greenback wallpaper, designed for a captivating visual experience.

Serene Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Image Digital Art

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Exquisite Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene for Your Screen

Find inspiration with this unique singapore dollar hits highest in over 11 years versus greenback illustration, crafted to provide a fresh look for your background.

Vivid Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene Illustration

Explore this high-quality singapore dollar hits highest in over 11 years versus greenback image, perfect for enhancing your desktop or mobile wallpaper.

Lush Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Background Illustration

A captivating singapore dollar hits highest in over 11 years versus greenback scene that brings tranquility and beauty to any device.

Vibrant Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Scene for Your Screen

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture in 4K

Discover an amazing singapore dollar hits highest in over 11 years versus greenback background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Gorgeous Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Landscape for Desktop

This gorgeous singapore dollar hits highest in over 11 years versus greenback photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Picture in 4K

Transform your screen with this vivid singapore dollar hits highest in over 11 years versus greenback artwork, a true masterpiece of digital design.

Breathtaking Singapore Dollar Hits Highest In Over 11 Years Versus Greenback Photo Art

Experience the crisp clarity of this stunning singapore dollar hits highest in over 11 years versus greenback image, available in high resolution for all your screens.

Lush Singapore Dollar Hits Highest In Over 11 Years Versus Greenback View for Desktop

This gorgeous singapore dollar hits highest in over 11 years versus greenback photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

Download these singapore dollar hits highest in over 11 years versus greenback wallpapers for free and use them on your desktop or mobile devices.