Bitcoin briefly breaks below $73,000 to lowest since November 2024 as heavy selling resumes

Bitcoin Briefly Breaks Below $73,000 to Lowest Since November 2024 as Heavy Selling Resumes

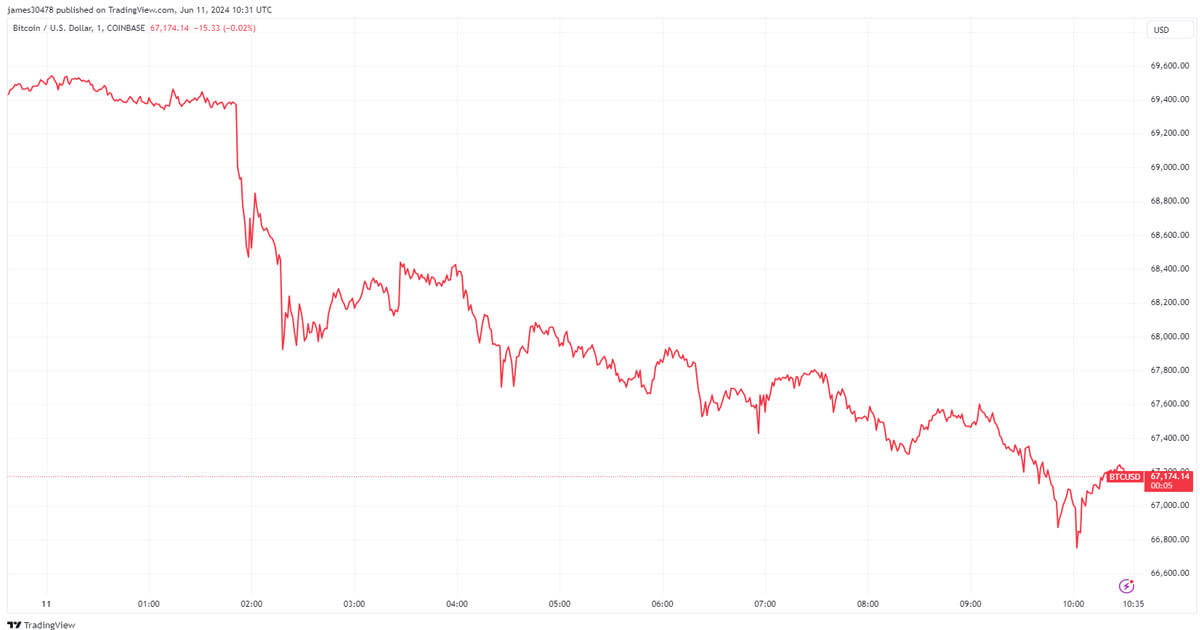

The cryptocurrency market was jolted awake this morning as Bitcoin (BTC) experienced a sharp, rapid descent, temporarily dipping below the crucial $73,000 mark. This aggressive price action pushed the leading digital asset to its lowest valuation point since late November 2024, signaling a fierce resumption of selling pressure that has caught many leveraged traders off guard.

For investors, the sudden drop felt like an echo of previous market corrections. Imagine logging in pre-market, expecting the usual sideways consolidation, only to see the BTC chart displaying a terrifying vertical red candle. The immediate reaction across social media and trading desks was one of frantic calculation: how deep will the pullback go, and what triggered this devastating move?

Within a narrow 60-minute window, Bitcoin shed over 6% of its value, evaporating billions in market capitalization. While BTC quickly rebounded to stabilize slightly above the $73,500 psychological barrier, the damage was done. The breach confirmed that the bullish momentum established earlier in the quarter had fundamentally stalled, pivoting the narrative back toward fear and *market uncertainty*.

The Anatomy of the Liquidation Cascade

The speed and depth of this specific drop point less towards organic profit-taking and more toward a coordinated structural breakdown involving high-frequency trading and forced liquidations. When Bitcoin breached the previously reliable *key support levels* around $75,000, it triggered a massive chain reaction.

Data from major derivatives exchanges indicates that over $850 million in long positions were liquidated within the initial 24 hours of the sell-off. This massive unwinding of *leveraged positions* exacerbated the downward momentum, creating a textbook *liquidation cascade* where forced selling drove the price lower, triggering yet more liquidations.

Retail traders who had entered the market near the recent peaks, using high leverage in anticipation of a quick move toward $80,000, were the primary victims. However, the sheer volume suggests that institutional capital also participated heavily, either in the initial selling wave or by setting aggressive stop-loss orders.

The market witnessed significant sell orders being executed by "whales" – large-volume holders – who recognized the fragility of the support structure. Their large block trades were absorbed slowly, indicating a temporary lack of buying conviction among institutional investors (e.g., Bitcoin ETF custodians) who might otherwise step in to "buy the dip" aggressively.

Technical indicators further underscore the severity. The Relative Strength Index (RSI) plunged into the oversold territory for the first time in months on the daily chart, a clear sign of panic. Furthermore, the 50-day moving average, a strong indicator of intermediate-term trend health, is now under severe threat, potentially confirming a bearish reversal if the price fails to recover swiftly above $76,000.

The immediate consequence is a shift in trading sentiment. Previously, traders were asking "when $80k?"; now, the question has become "can we hold $70k?"

Unpacking the Triggers: Macroeconomic Headwinds and Regulatory Pressure

While the immediate cause was structural (liquidations), the underlying reasons for this renewed heavy selling are deeply rooted in global *macroeconomic uncertainty* and shifting regulatory landscapes, compounded by specific sector news.

1. Federal Reserve Policy Uncertainty

The primary macroeconomic dampener remains the ongoing dialogue around interest rates. Recent statements from the *Federal Reserve* regarding stubborn inflation figures have dampened hopes for immediate rate cuts. Higher-for-longer interest rates make risk assets, including cryptocurrencies, less attractive compared to fixed-income assets. This direct correlation between sustained hawkish monetary policy and crypto dips is unavoidable.

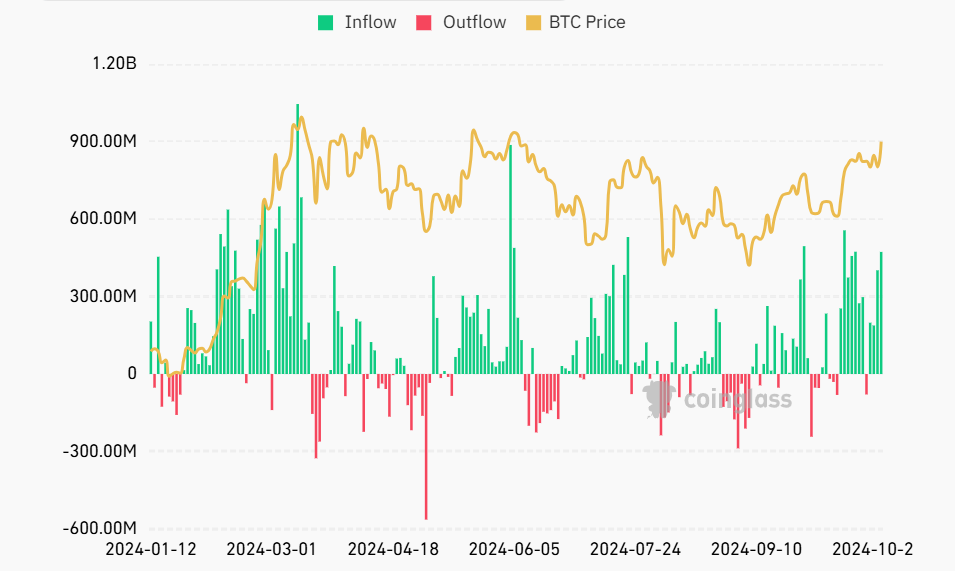

2. Institutional Outflows and ETF Activity

The introduction of spot Bitcoin ETFs was a monumental success in 2024, providing stable access for traditional finance. However, the last week saw consecutive days of net outflows from some key ETFs. While these outflows were marginal compared to the total assets under management, they signaled a lack of fresh *institutional capital* injection, creating a vacuum that sellers quickly exploited.

Specific examples include a major ETF seeing its largest single-day redemption since its launch, which analysts attribute to large financial institutions reallocating profits away from crypto and into potentially less volatile sectors due to quarter-end reporting requirements.

3. The Contagion from Altcoins

The downturn wasn't isolated to Bitcoin. Many major altcoins—Ethereum, Solana, and others—saw even more dramatic double-digit percentage losses. This broad *crypto market volatility* suggests that the decline is driven by systemic risk aversion rather than unique factors affecting BTC. When Altcoins bleed faster, it prompts BTC holders to sell defensively, fearing a broader market collapse.

4. Regulatory FUD (Fear, Uncertainty, Doubt)

Rumors regarding stricter regulatory oversight in key jurisdictions, particularly regarding stablecoins and DeFi lending platforms, added friction to the market. Although not confirmed, the fear that regulators might move aggressively post-election has created an environment where traders prefer liquidity over exposure.

The combination of these factors painted a target on the $75,000 support level. Once it gave way, the market mechanism took over, turning fear into panic.

What's Next? Key Support Levels and Path to Recovery

Market analysts are now focused intensely on identifying where Bitcoin can find solid footing to halt the sustained decline. The immediate battleground is critical, as a failure to hold current levels could open the door to a much deeper correction.

The current price action highlights several critical levels:

- **Immediate Support ($73,000):** This is the psychological barrier and the flash low. Holding here is crucial to prevent further panic selling.

- **The 100-Day Moving Average ($71,200):** This technical indicator represents a strong historical accumulation zone. If the price reaches this level, we expect significant institutional bids to materialize.

- **Major Consolidation Base ($68,500):** This level served as the breakout point for the move toward the recent all-time high. A move back here would represent a full retracement of recent gains and would be a devastating blow to near-term sentiment.

For Bitcoin to regain its footing and reverse the trend, several conditions must be met:

Firstly, the daily net flows for the U.S. spot ETFs must return to positive territory, indicating renewed demand from large, stable *institutional investors*. Secondly, clarity is needed from central banks, perhaps signaling a softer stance on future rate hikes, which would alleviate macroeconomic pressure.

Finally, the market needs a significant catalyst—perhaps a major positive development in regulatory certainty or a large-scale adoption announcement—to shift the narrative away from fear. Without new compelling narratives, the market risks prolonged consolidation or further erosion toward the $70,000 mark.

Senior analysts emphasize the importance of viewing this decline within the broader context of Bitcoin's long-term cycle. While painful, the volatility is inherent to the asset class. The move below $73,000 is a stern test of investor conviction, but history shows that such sharp corrections often precede healthier consolidation phases, washing out excess leverage and setting the stage for more sustainable growth later in the cycle.

Investors are advised to practice prudent risk management, focusing on dollar-cost averaging rather than attempting to catch the proverbial "falling knife" during periods of extreme price discovery and intense selling pressure.

Bitcoin briefly breaks below $73,000 to lowest since November 2024 as heavy selling resumes

Bitcoin briefly breaks below $73,000 to lowest since November 2024 as heavy selling resumes Wallpapers

Collection of bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpapers for your desktop and mobile devices.

Breathtaking Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Landscape Art

Discover an amazing bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Vibrant Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Scene Art

Transform your screen with this vivid bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes artwork, a true masterpiece of digital design.

Lush Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes View for Desktop

Find inspiration with this unique bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes illustration, crafted to provide a fresh look for your background.

Beautiful Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Picture in HD

Experience the crisp clarity of this stunning bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, available in high resolution for all your screens.

Vivid Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Photo Illustration

Explore this high-quality bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, perfect for enhancing your desktop or mobile wallpaper.

Vibrant Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Capture Art

Experience the crisp clarity of this stunning bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, available in high resolution for all your screens.

Crisp Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Landscape Concept

Immerse yourself in the stunning details of this beautiful bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpaper, designed for a captivating visual experience.

Gorgeous Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Scene Art

This gorgeous bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes photo offers a breathtaking view, making it a perfect choice for your next wallpaper.

High-Quality Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Photo Nature

Discover an amazing bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes background image, ideal for personalizing your devices with vibrant colors and intricate designs.

Mesmerizing Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Abstract Concept

Experience the crisp clarity of this stunning bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, available in high resolution for all your screens.

:max_bytes(150000):strip_icc()/INV_BitcoinIllustration_GettyImages-2158757103-55a742841f634b6cb5865e89b942ab1c.jpg)

Artistic Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Design in 4K

Immerse yourself in the stunning details of this beautiful bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpaper, designed for a captivating visual experience.

High-Quality Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Image Art

Experience the crisp clarity of this stunning bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, available in high resolution for all your screens.

Spectacular Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Moment Illustration

Immerse yourself in the stunning details of this beautiful bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpaper, designed for a captivating visual experience.

Exquisite Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Design Photography

Find inspiration with this unique bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes illustration, crafted to provide a fresh look for your background.

Artistic Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Wallpaper in 4K

Find inspiration with this unique bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes illustration, crafted to provide a fresh look for your background.

Vivid Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Image Photography

Experience the crisp clarity of this stunning bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, available in high resolution for all your screens.

Detailed Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Picture Digital Art

Transform your screen with this vivid bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes artwork, a true masterpiece of digital design.

Captivating Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Artwork Nature

A captivating bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes scene that brings tranquility and beauty to any device.

Stunning Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes View Photography

Immerse yourself in the stunning details of this beautiful bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpaper, designed for a captivating visual experience.

High-Quality Bitcoin Briefly Breaks Below $73,000 To Lowest Since November 2024 As Heavy Selling Resumes Moment for Desktop

Explore this high-quality bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes image, perfect for enhancing your desktop or mobile wallpaper.

Download these bitcoin briefly breaks below $73,000 to lowest since november 2024 as heavy selling resumes wallpapers for free and use them on your desktop or mobile devices.